2013 Downtown Chicago Apartment Trends: Luxury Rentals Edition

With the new year comes the first wave of new downtown Chicago luxury apartment buildings. I’ve been watching the construction sites closely and receiving regular updates from developers so Luxury Living Chicago can begin to market properties such as Coast at Lakeshore East, AMLI River North, 500 Lake Shore Drive and K2 at Kinzie Station.

I’ve been thinking a lot about what the coming year holds for the luxury apartment market in downtown Chicago. Here are a few of my predictions regarding what will impact residential leasing in Chicago’s most high-end rental buildings.

Properties will be more luxurious than ever before. I’ve had the opportunity to tour the building sites first hand and speak directly with developers of rental buildings coming online this year. The vision is the same across the board. The next generation of Chicago luxury apartment buildings will be more updated, more focused on convenience, service and amenity driven than their predecessors. The units will feature mostly hardwood flooring, highly designed kitchens and thoughtful floor plans including great closet space.

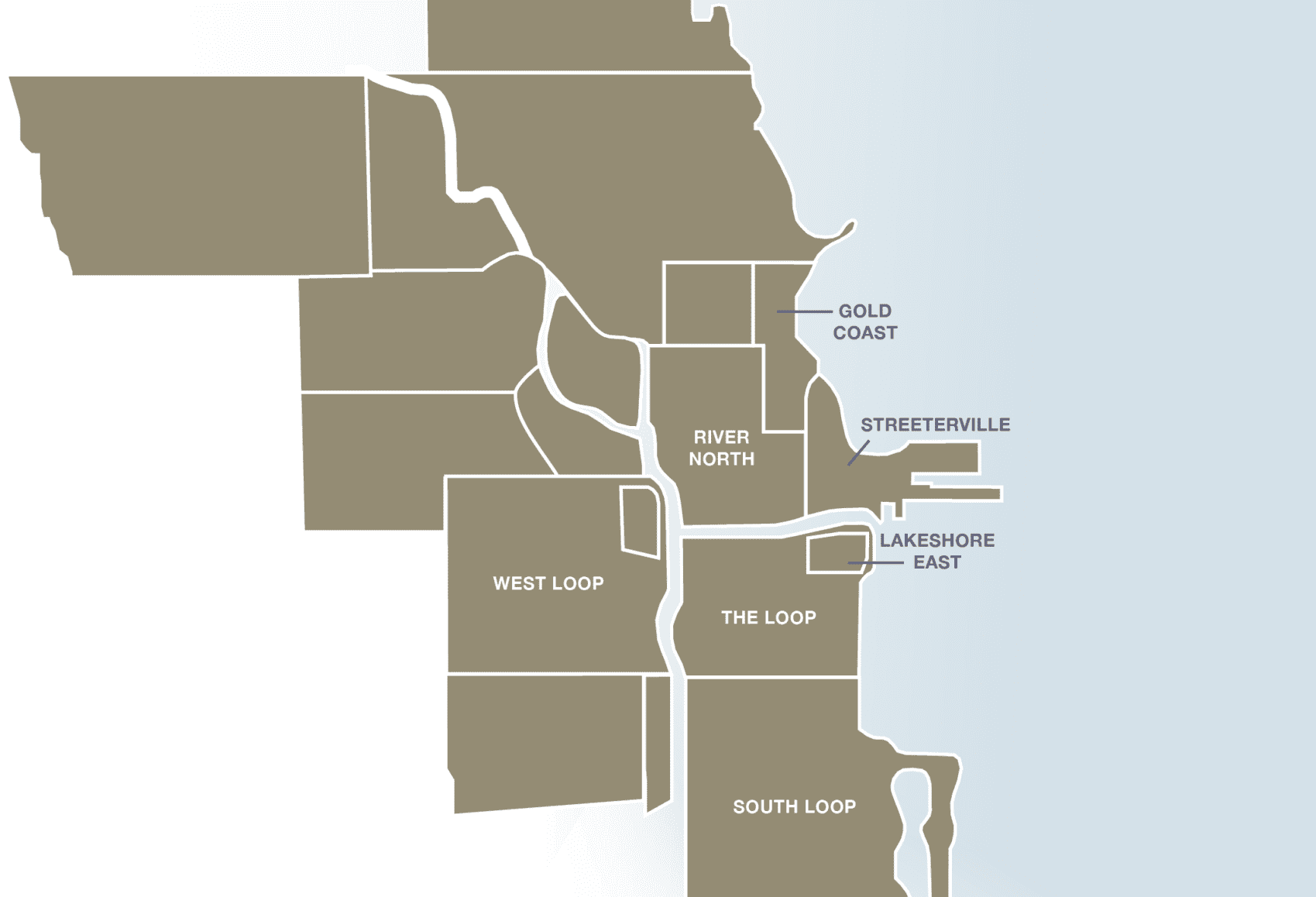

Locations that can not be beat. The buildings opening this year have some of the best locations in the city. This is because the sites were originally earmarked for condo developments. When the condo market went bust, multi-family housing went boom. Developers jumped on the demand and tweaked their plans to build rental apartments versus condo buildings. AMLI River North is smack in the heart of River North, while Coast at Lakeshore East will feature some of the best views of Lake Michigan.

People will move. In 2012 we found a good percentage of our past clients stayed put in the apartments we had rented to them the previous year. Pricing was a little too high to make moving financially feasible. This year tenants are ready for a change of scenery and an upgrade in their living environment. Apartment lease-ups typically mean move-in incentives to entice prospective tenants. Look for special offers from the new buildings. Not to mention the rental buildings built just a few years ago won’t be the newest kids on the block anymore. These slightly older buildings will have to work to retain residents and maintain the high occupancy rates we saw throughout 2012. Pricing will have to come down at those building to attract new tenants.

Private investors will still be able to command higher rents for their properties. Last year many private condo investors were able to up rental prices by 15-20 percent on their units. Chicago condo rentals were also in demand as they offered tenants a luxury product at a slightly lesser price point than the managed apartment buildings. This year, I’m advising my private condo investors that they should raise rents again about 5-10 percent to continue to put themselves in a competitive position with the managed buildings.

While 2012 saw high pricing and high occupancy rates with little movement, 2013 promises exciting lease-ups, fresh new buildings, and plenty of luxury housing options for the downtown Chicago apartment renter.

Search The Blog

Most Popular

The 7 Neighborhoods of Downtown Chicago

How to Estimate Utility Costs for Your Chicago Apartment

How Do Chicago Apartment Finders Get Paid?

About Us

Up Next

Things to Do in Downtown Chicago Over the Holidays

UPDATED FOR 2013! So you just moved to Chicago (or maybe you’ve lived here a while) and you’re looking for fun things to do […]

Downtown Chicago Apartment Searching in December

December is always an interesting month to search for downtown Chicago apartments. It is getting colder and people are looking forward to the holidays. […]

AMLI River North Chicago: The Building Everybody is Talking About

Last week I had the privilege of taking an exclusive tour of the newest River North luxury apartments – AMLI River North. AMLI River North […]

Getting the Most Out of Your Downtown Chicago Condo Investment Property

As the managing broker and owner of Luxury Living Chicago, I consult condo owners and investors daily about prices, trends and market conditions. There […]