How to Get Renters Insurance for An Apartment

Renters insurance is a type of insurance policy that is designed to protect tenants from financial loss due to unexpected events, such as theft, fire, or water damage. Despite its importance, many renters still do not have renters insurance. In this blog, we will provide an overview of renters insurance and why it’s necessary, as well as a step-by-step process for finding and obtaining renters insurance.

What is Renters Insurance?

Renters insurance provides coverage for personal property, liability protection, and additional living expenses.

- Personal property coverage includes protection for your belongings, such as furniture, electronics, and clothing.

- Liability protection covers legal fees and damages if someone is injured on your property or if you cause damage to someone else’s property.

- Additional living expenses coverage provides temporary housing and other living expenses if your apartment becomes uninhabitable due to a covered event.

Is Renters Insurance Necessary?

Many renters assume that their landlord’s insurance policy will cover their personal belongings in the event of a disaster, but this is not the case. A landlord’s insurance policy typically only covers the building itself and not the tenant’s personal property. Additionally, renters can be held liable for damages or injuries that occur on their property, making liability coverage essential.

How to Get Renters Insurance

- Determine your coverage needs. Before you start shopping for renters insurance, it’s important to determine how much coverage you need. Consider the value of your personal belongings and any potential liability risks.

- Shop around for quotes. Shop around for quotes from multiple insurance providers to ensure you’re getting the best coverage at the best price. Consider factors such as deductibles, coverage limits, and additional living expenses coverage.

- Choose a policy and provider. Once you have received quotes from multiple providers, compare the coverage and pricing to select the best policy and provider for your needs.

- Submit your application and pay the premium. Complete your application and pay the premium to secure your renters insurance policy.

- Review your policy and make adjustments if necessary. Review your policy to ensure it provides the coverage you need. Make any necessary adjustments, such as increasing coverage limits or adding additional riders.

In conclusion, obtaining renters insurance is an important step for protecting yourself and your belongings as a tenant. By following this step-by-step process, you can find and obtain the best renters insurance policy for your needs. If you need help with your apartment planning process, reach out to the Luxury Living team for expert guidance and support.

Search The Blog

Most Popular

How to Estimate Utility Costs for Your Chicago Apartment

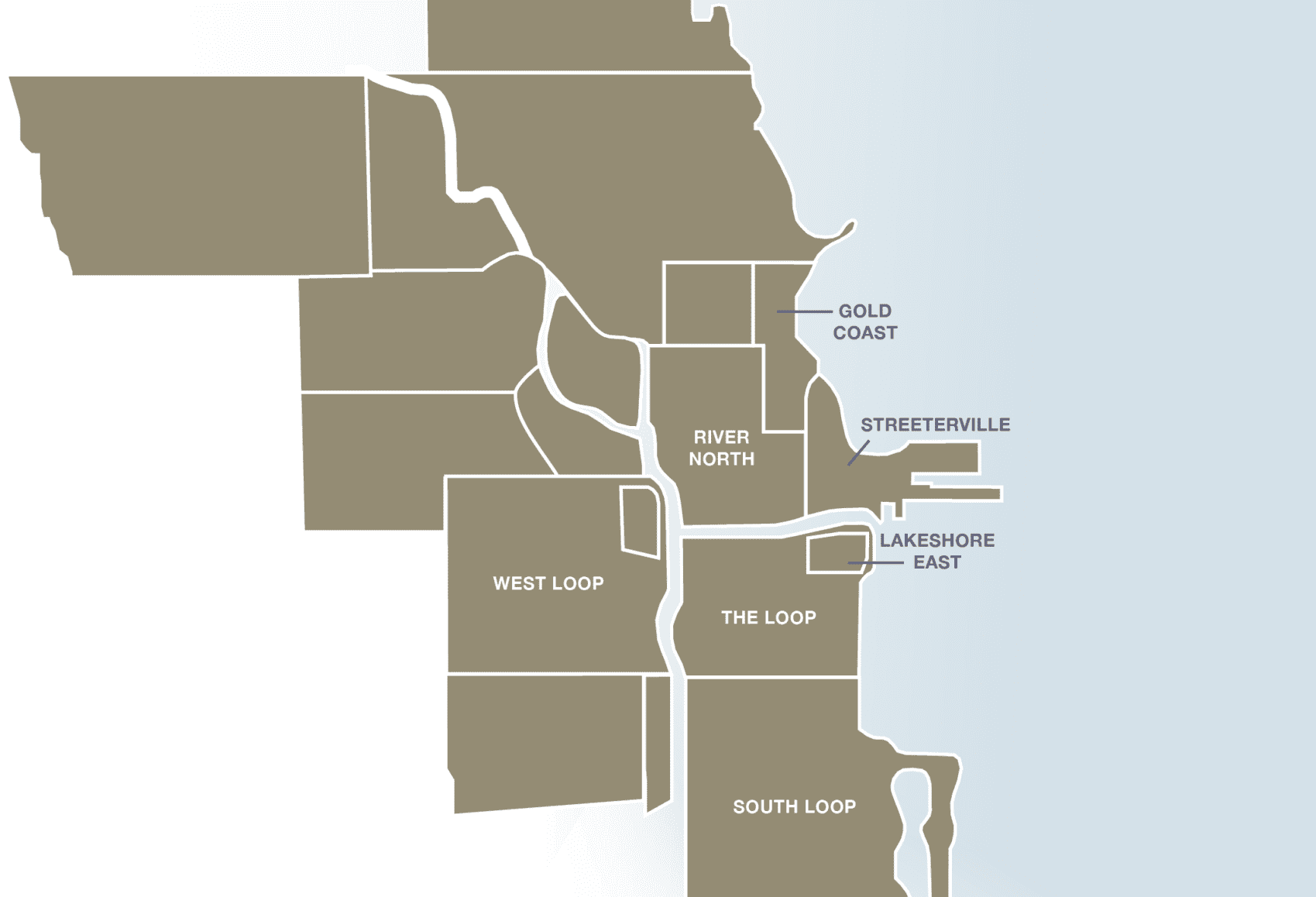

The 7 Neighborhoods of Downtown Chicago

How Do Chicago Apartment Finders Get Paid?

About Us

Up Next

Chicago Apartments that Rival the Most Exquisite Chicago Luxury Penthouses

Not long ago, Chicago luxury penthouses were the gold standard of living accommodations in the city. They were particularly ideal for eligible bachelors and […]

5 Unexpected Perks of Living in Luxury Penthouses in Chicago

Living in a luxury penthouse in Chicago is the dream for a lot of people. They offer stunning views, luxurious interiors, and often make […]

8 Things to Know Before Renting an Apartment

To ensure the smoothest living experience, there are some important things to know before renting an apartment, especially if you’re a first-time renter. We’ve […]

Where to Live in Chicago for Match Day 2023 – Cadence Apartments

Match Day is an exciting time for medical residents who are about to start their residency programs. It’s a time of new beginnings and […]